By K R Sudhaman

The joke going around social media is that an economic reporter wanted to interview finance minister Arun Jaitley. But Jaitley said he would talk only on cricket. The reporter, happy that he got at last a chance to ask Jaitley some questions if he should start with batting or bowling. Jaitley said start with toss. The peeved reporter asked why toss, Jaitley immediately said that is the only time Indian rupee goes up.

But jokes apart, rupee value has been sliding down freely, though partly due to strengthening of dollar and it has been a matter of concern for the economy. Also it has come at a time when global crude oil prices are hardening and India’s current account deficit is widening alarmingly.

Usually a falling rupee is a double-edged weapon. It helps exports, particularly when it is on a recovery mode. But it makes imports more expensive, especially when India imports 80 per cent of its crude oil requirement. Free fall of rupee now at over Rs 72 to a dollar, and that too volatile, makes it risky for the economy.

The current account deficit is widening in India because of two reasons — Demonetisation and the hasty rollout of GST. These measures impacted the informal sector badly, which accounted for nearly 80 per cent of the jobs in the country. Informal sector, with MSMEs included, accounted for nearly 45 per cent of India’s exports, mainly the labour-intensive sectors like leather, textiles, handlooms, handicrafts, gems and jewellery. This informal sector also catered to the large domestic market as well accounted for nearly 40-50 per cent consumption of manufactured goods.

With demonetization hitting the informal sector, domestic consumption of locally manufactured goods has been substituted by cheap imports from China. That apart, Make in India has not taken off to the extent it should have and hence there has been huge imports of electronics goods, which is next only to oil and gold imports.

India has, therefore, been hit on both counts: low exports and high imports, widening the trade deficit and the current account deficit, much more than the desirable level. The falling rupee value has worsened the situation. The trade deficit is expected to be close to a record $200 billion and CAD at an unsustainable level of nearly 3 per cent of GDP this financial year.

But this did not mean India should make efforts to control imports. Instead, it should step up exports through massive reforms, take steps to attract labour-intensive export units shifting base from China. At the moment most of them are going to Vietnam, Cambodia, Bangladesh and so on. India has huge potential to attract them, particularly in textiles and leather if only the government gave some incentives, created conducive environment and cut the red tape.

Knee-jerk reactions are best avoided and import restrictions will lead to only increased protectionism and past experiences have shown globalization has only helped both emerging and advanced economies in trade as well as growth. The government recently announced some measures to attract short-term capital inflows and eased external commercial borrowing norms. But the question is why would there be some capital inflows or domestic companies borrow from abroad when investment climate is uncertain. Even with current account deficit at 2.5 per cent of GDP, India could still grow at 8 per cent. If it breaches 3 per cent of GDP, it is a matter of concern and steps would be required.

According to former RBI governor Raghuram Rajan, falling rupee is not too big a worry right now. He feels it has not depreciated to a worrying level. The Indian rupee has weakened nearly 10 per cent so far this year making it the worst performing Asian currency. It is dollar’s strength that is depreciating many emerging market currencies. Rajan’s advice to the government is that India should focus on strengthening its macroeconomic fundamentals instead of worrying about the depreciating rupee. Bringing down current account deficit and maintaining fiscal deficit is more important. This will make the investors more confident and economy would get kick-started.

Also to some extent the depreciating rupee is good as the government has been pursuing implicit strong rupee policy for three or four years. It was time for some correction, which of course has to be orderly. The government recently announced an array of steps to boost exports. This included removal of withholding tax on masala bonds, relaxation on non-portfolio investments and some restrictions on non-essential imports.

India’s share in goods exports was less than 2 per cent in world exports as against China’s nearly 14 per cent. But in services exports our performance is slightly better at around 3.5 per cent of world exports. Today there is yet another opportunity for India to become a global exports hub if the right policy is put in place to push both goods and services exports.

The finance ministry has come out with two separate working papers on the challenges and policy initiatives needed to take India’s goods and services exports to a new high. They suggest that it is possible to take India’s share in world exports to a respectable five per cent. For this India’s goods exports should reach $882 billion by 2022, which means India’s export growth rate needed to be around 27 per cent CAGR in five years. This is not impossible as India has had higher exports growth than this during 2004-09.

Services exports, which had gone from $53 billion in 2005 to $162 billion annually in 2016, have done better than goods exports in the first half of 2017-18 at 16.2 per cent growth Various initiatives have already been taken to push services exports but more needs to be done, considering that the ill-effects of demonetization and rollout of GST are now behind us.

India’s goods exports have to be made demand based rather than supply based as at present. Regarding services exports, there is a need for ‘services from India’ initiative just as make in India initiative to promote manufacturing exports from the country.

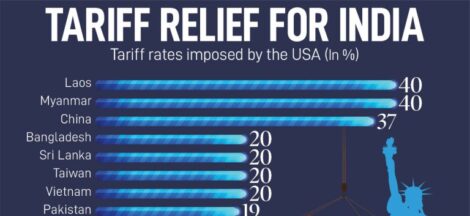

There is need for rationalizing tariffs. Though average customs duty is around 10 per cent, the real applied duty is around 2.8 per cent because of various exemptions provided. This is creating distortions. The US-China trade war too has opened up some opportunity for India to boost exports. There are some low hanging fruits. But India would have to work upon them to convert into an opportunity.

Overall there are some alarm bells on India’s external situation and if tackled appropriately, India can overcome the hump .What is needed is right policies and incentives. Knee-jerk and adhoc measures need to be avoided. Jaitley should ensure fiscal slippages are avoided and take appropriate measures to ward off the ill effects of surging fuel prices. (IPA Service)

The picture is taken from the Internet.

The post Rupee Fall May Not Be Bad By Itself appeared first on Newspack by India Press Agency.